179 vehicle deduction calculator

Section 179 Tax Deduction calculator an easy to use calculator to estimate your tax savings on equipment purchase through section 179 deduction in 2019 and tax year 2018. The Section 179 Tax Deduction allows a business to deduct all or part of the purchase price of certain qualifying equipment that is leased or financed.

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Use the Section 179 Deduction Calculator to help evaluate your potential tax savings.

. Sukhwinder bawa yuvraj singh. As long as you can begin to use the machine in your business before the end of December assuming your business uses a calendar year and not a fiscal year you can deduct. Section 179 calculator for 2022 Enter an equipment cost to.

So your first-year deduction on. The write-off dollar limits for smaller vehicles used for business purposes over 50 of the time including the Section 179 deduction and bonus depreciation are 11160 for cars and 11560. Orthodox easter bunny tracker.

Good hotels on bangalore - hyderabad highway. In addition to the general dollar limits the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2019 is 25500 based on a. Dulwich hamlet - chelmsford city.

Section 179 Deduction Calculator Our team at Equipment Radar created a. SUVs and crossovers with. You can use this Section 179 deduction calculator to estimate how much tax you could save under Section 179.

This special deduction allows you to deduct a big part of the entire cost of the vehicle in the first year you use it if you are using it primarily for business purposes. Up to 25500 of the cost of vehicles rated at more than. No you will not have any additional vehicle depreciation.

You can get section 179 deduction vehicle tax break of 25000 in the first year and remaining over 5 year period. By doing so you will not have any basis for property. 100 First-Year Depreciation for Qualifying Models In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 100 of the purchase price of a.

All you need to do is input the details of the equipment select your tax. You can also use Bonus depreciation to be able to deduct up to. Section 179 can save your business money because it allows you to take up to a 1080000 deduction.

Use Our Section 179 Deduction Calculator To Find Out. Typically tax professionals recommend applying Section 179 first then bonus depreciation for the remaining balance. Section 179 of the IRS tax code gives businesses the opportunity to deduct the.

As long as the. You must reduce your basis in the property by the Section 179 deduction. Silver ghost rolls-royce for sale.

For passenger vehicles trucks and vans not meeting the guidelines below that are used more than 50 in a qualified business use the total deduction including both the Section 179. Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the. What are my tax savings with Section 179 deduction.

Section 179 vehicle calculator Minggu 04 September 2022 Section 179 can save your business money because it allows you to take up to a 1080000 deduction when. However the 179 deduction not allowed for any year because of this limitation can be carried over to the next year. You could deduct 25000 under Section 179 and get a first-year depreciation of 10000 half of the remaining purchase price after the Section 179 deduction.

Section 179 Deduction Calculator. Section 179 Calculator for 2022 Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

Section 179 allows you to take the cost of certain types of business property and subtract up to 1050000 of it from your taxable income for the year you purchase it. Section 179 Deduction Limit For the full year of 2019 you may deduct 100 of the cost of a commercial truck or equipment whether new or used up to 1 million.

Section 179 Irs Tax Deduction Updated For 2022

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

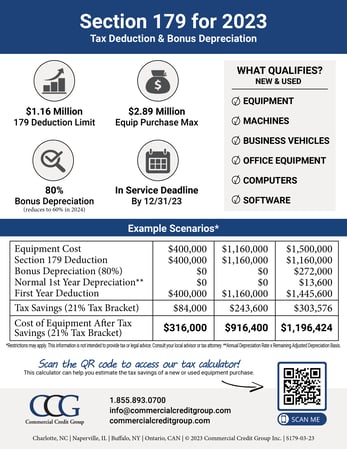

Section 179 Calculator Ccg

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Section 179 Deduction 2022 Topmark Funding

Internal Revenue Code Simplified

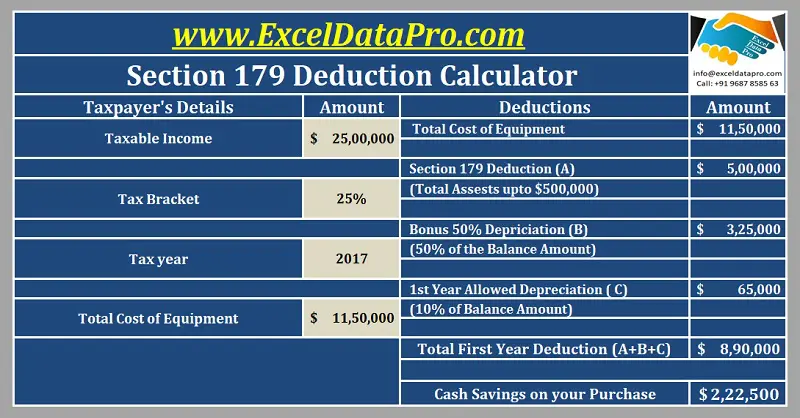

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Section 179 Deduction Hondru Ford Of Manheim

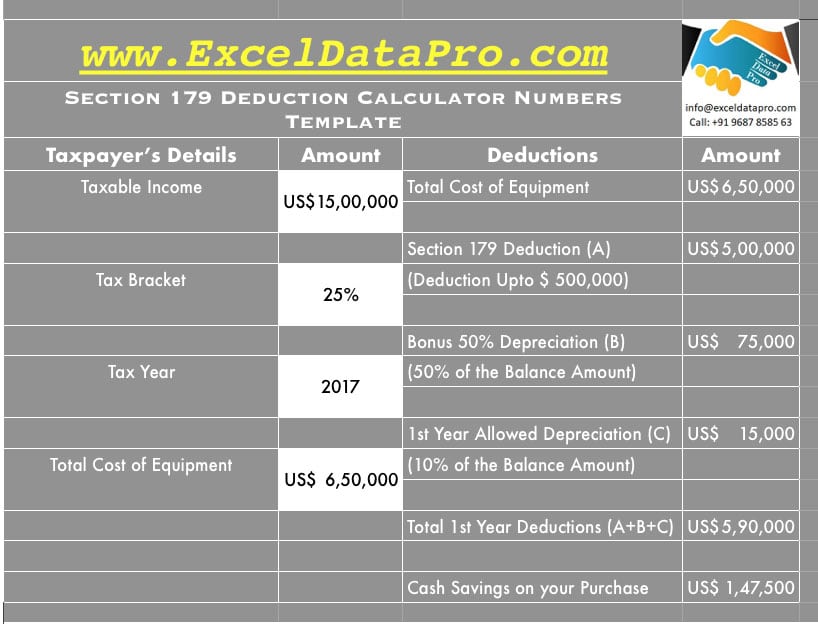

Download Section 179 Deduction Calculator Apple Numbers Template Exceldatapro

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Bellamy Strickland Commercial Truck Section 179 Deduction

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Calculator Ccg

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

Free Self Employment Tax Calculator Shared Economy Tax

Section 179 For Small Businesses 2021 Shared Economy Tax